Navigating the unpredictable terrain with prudence holds the key for market investors

Market participants must recognize that embracing fluctuation is not a sign of vulnerability but a strategic necessity

image for illustrative purpose

Utaar-Chadhav Swabhav Nahin, Samjho Bazaar Ki Paribhashaa Hai;

Bazaar Se Ekdam Door Raho Agar Rekhiya Samikaran Ki Ashaa Hai-Shivam

Translation: Fluctuation is not the nature; it is essentially the capital market’s definition.

Stay away from the capital market if you expect return to be a linear equation.

In the ever-evolving realm of finance, the concept of fluctuation is not merely a deviation but rather the very essence and definition of the capital market. The idea that the market adheres to a linear equation is a fallacy that can potentially lead to mistaken decisions, resulting in financial pitfalls. To truly comprehend the intricacies of market dynamics, one must embrace the reality of fluctuation and adapt strategies accordingly. Capital market per se is characterized by change and unpredictability.

Seasons shift, ecosystems evolve and the natural world is in a perpetual state of flux. Similarly, the financial markets embody this inherent variability. Attempting to impose a linear equation onto the market is akin to trying to fit a square peg into a round hole-it defies the fundamental nature of the beast.

The stock market is notorious for its fluctuations. The rise and fall of prices are based on an intricate web of factors, including economic indicators, geopolitical events, corporate earnings and market sentiment, among others. A linear equation fails to encapsulate the complexity and interconnectedness of these variables.

The notion of a straight, unswerving trajectory overlooks the very essence of financial markets, where volatility is not an anomaly but a defining characteristic. This realization is crucial for anyone venturing into the world of investments.

Market participants must recognize that embracing fluctuation is not a sign of vulnerability but a strategic necessity. Rather than shying away from volatility, successful investors navigate through it, leveraging fluctuations to their advantage. Equities can potentially deliver higher returns over the long term, making them suitable for those willing to accept market fluctuations.

In the short run, the market is a voting machine, but in the long run, it is a weighing machine-Benjamin Graham

Often considered as the father of value investing, Graham reminds us that though market sentiment may cause short-term price swings, it will reflect the intrinsic value of assets in the long run. As an investor, it is therefore important that one considers long-term perspective and make decisions based on fundamental analysis.

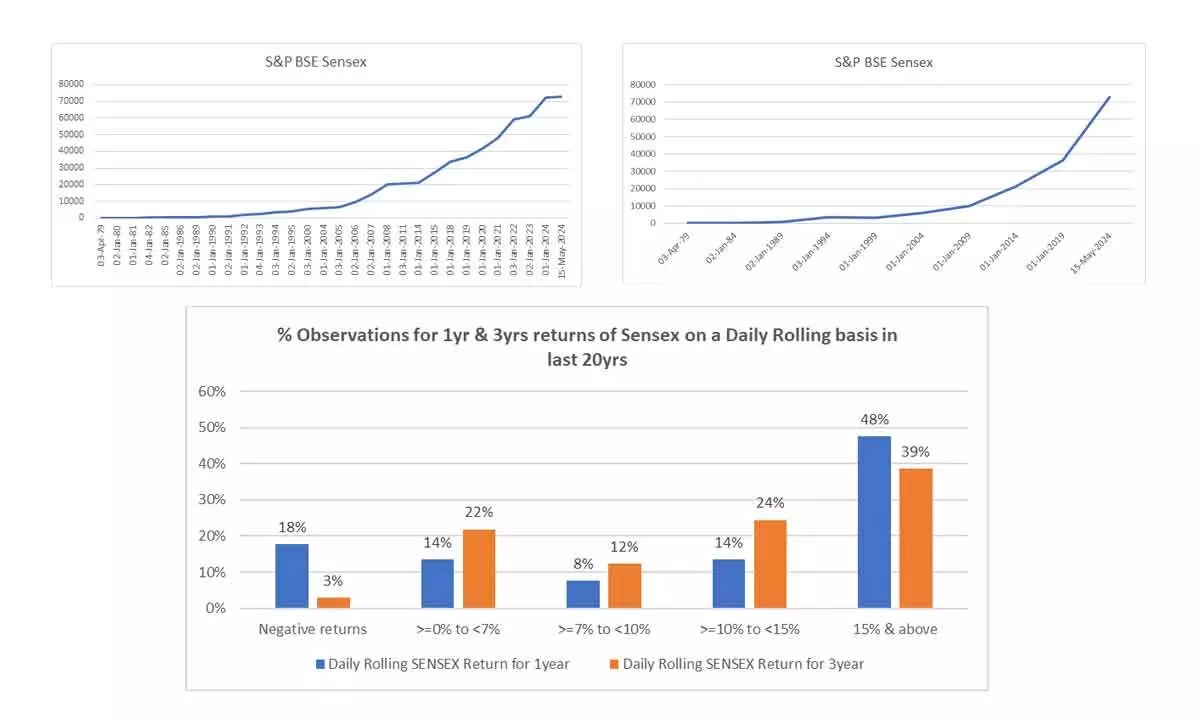

If we observe the below Sensex graph since its inception, it is evident that equity markets have been very volatile. Equity markets have witnessed many corrections in past, but the earnings of the Companies in the Nifty basket and their intrinsic value has given support and the bounce-back from each low has been phenomenal. Despite major corrections, BSE Sensex has grown over 750 times in 45 years clocking a CAGR of 16%

When we reduce the number of data points, the resulting graph tends to exhibit greater linearity. This observation suggests that without vigilant monitoring of volatility, the movements within the equity market may adopt a more linear trajectory, potentially masking underlying fluctuations.

The below two charts are plotted with yearly and five yearly values.

On the other hand, Bank Fixed deposits (FDs) offer safety, stable returns, and are ideal for conservative investors seeking capital preservation with a fixed growth rate. Such an investment is apt for investors looking for linear movement of their investments. But this linearity is just by seeing the nominal return. However, fluctuating inflation impacts the real rate of return greatly, adding volatility.

Traveling along a highway can be pleasurable initially, but it may become mundane over a period of time. The true excitement arises when riders encounter uphill, downhill, or off-road challenges. Negotiating twists and turns adds an adrenaline rush for the driver, and the panoramic views at the summit or base of hills are awe-inspiring. This fusion of navigating difficult landscapes and enjoying breathtaking scenery creates an unforgettable experience.

Similarly, in investments, investors often find excitement in navigating market volatility and achieving rewarding returns.

It is rightly said that one shouldn’t work for money but make money work for them. Investments help in achieving ones’ financial goals by creating multiple channels of income. It may involve diversifying the portfolio across different asset classes such as fixed deposits, stocks, bonds, gold and real estate and using various investment vehicles such as mutual funds, exchange-traded funds (ETFs), or individual securities. A diversified portfolio, risk management strategies, and a keen awareness of market trends become indispensable tools in the investor’s toolkit.

The one-year and three-year daily rolling returns of Sensex are shown hereunder. The chart shows that returns over a longer period tend to be less volatile. In percentage terms, the number of times sensex would have posted negative returns reduces from 18% for one-year returns to three per cent for three-year returns.

In investing, what is comfortable is rarely profitable - Robert Arnott Playing safe may not always work in one’s favour. Seeking comfort or safety in investments may not always lead to the most significant returns. To achieve considerable gains, it might be necessary to step outside one’s comfort zone and take calculated risks.

In conclusion, the admonition to “stay away from the market if one expects a linear equation” serves as a profound reminder to investors and traders alike. Embracing the fluctuating nature of the market is not a concession to chaos but recognition of its inherent characteristics.

Success in the financial realm demands adaptability, a keen understanding of market forces, and the ability to navigate the unpredictable terrain with prudence. As the market ebbs and flows, those who recognize and embrace its fluctuations are better positioned to thrive amidst the dynamic landscape of investments.

(The writer is executive vice-president, SBI Funds Management Ltd; Translation and content by Himanshu Hemrajani, deputy vice-president, SBI Funds Management Limited)